Blog

Learn how title insurance protects property owners during eminent domain. Discover steps to safeguard your rights and secure fair compensation.

In an age where technology continuously reshapes how we conduct transactions, e-closings, and digital signatures have emerged as transformative forces in the real estate industry. These innovations streamline the buying and selling process, offering numerous advantages over traditional paper-based closings. At True Concept Title Company , we embrace these advancements to provide clients with a seamless and efficient closing experience. Here’s a closer look at the key benefits of e-closings and digital signatures. Convenience and Accessibility One of the most significant advantages of e-closings is their unparalleled convenience. Digital transactions eliminate the need for all parties to gather in person, allowing buyers, sellers, and agents to close deals from virtually anywhere in the world. This flexibility is particularly beneficial for individuals with tight schedules or those living in different locations. E-closings also empower you to review documents at your own pace. You can sign digital documents securely at a time that suits you, reducing the pressure to finalize everything in a meeting. This convenience translates to a more relaxed and stress-free experience for everyone involved. Enhanced Security Measures Digital signatures offer enhanced security features that protect the integrity of your documents. Electronic transactions often utilize encryption and secure identities to ensure that signatures are genuine and documents aren't altered post-signature. Many e-closing platforms offer audit trails , allowing you to trace every step of the signing process. This transparency provides peace of mind, as both parties can verify the authenticity of the documents and who accessed them. Additionally, digital storage of these documents reduces the risk of loss or damage compared to physical papers. Increased Efficiency and Speed E-closings significantly expedite closing, reducing the time to finalize real estate transactions. By eliminating the back-and-forth associated with mailing documents, closings can be completed more rapidly. This speed is particularly useful in competitive markets where timing can influence the success of a deal. Furthermore, e-closings streamline communication between all parties involved. Any changes or updates can be managed in real time, ensuring everyone stays informed and on the same page and reducing the likelihood of miscommunication. Environmentally Friendly Practices The shift from paper-based transactions to digital signatures contributes to more sustainable and environmentally friendly business practices . By minimizing the need for printed documents, e-closings help reduce paper use and the carbon footprint of transporting physical documents. This eco-friendly approach is becoming increasingly important to clients conscious of their environmental impact. By adopting digital solutions, you contribute to a more sustainable future while enjoying the benefits of modern technology. Cost Savings E-closings can also lead to significant cost savings. By reducing the need for physical resources such as paper, printing, and postage, you can cut down on these expenses. Additionally, the increased efficiency of digital processes can save on administrative and labor costs. Moreover, fewer errors occur in digital processing, reducing costs associated with correcting mistakes commonly encountered in manual paperwork processing. Conclusion: As the real estate industry evolves, embracing e-closings and digital signatures represents a move towards greater efficiency, security, and convenience. At True Concept Title Company, we are committed to leveraging these technologies to enhance your closing experience. Whether buying or selling, consider opting for an e-closing to enjoy its many benefits. Ready to experience the convenience of e-closings and digital signatures? Contact True Concept Title Company today to learn how we can simplify your home transaction process with the latest digital solutions. Embrace the future of real estate with us!

Introduction: Preparing for Your Closing Day Closing day is the final step in the home buying or selling journey, transitioning you from negotiations to home ownership. While it’s an exciting milestone, it can also bring a mix of stress and potential anxiety. Preparation can help ensure this big day is straightforward and stress-free. At True Concept Title Company, we aim to give you the knowledge and tools to streamline your closing process. Organize All Necessary Documents Having all necessary documents systematically organized is key to ensuring an efficient closing day. These typically include: Purchase Agreement: A critical document that outlines the terms agreed to by both parties. Proof of Homeowner’s Insurance: Lenders require proof of insurance to confirm that the property is insured, protecting your and their investment. Government-issued identification, Such as a driver’s license or passport, to verify your identity. Closing Disclosure Statement : Provided at least three days before closing, this statement outlines your loan's final terms, payments, and costs. Financial Documentation: Recent bank statements, pay stubs, or other financial information as your lender requires. Properly organizing these documents prevents last-minute scrambles and ensures that all parties move through the process fluidly. Consider creating a checklist and using a secure folder to keep everything organized and accessible. Also, please make sure to have copies of your documents in physical and digital formats in case anything needs to be found. Review the Closing Disclosure Carefully The Closing Disclosure is a document indicating your mortgage's final costs and terms. Receiving it at least three days before closing gives you ample time to review thoroughly: Interest Rate and Loan Terms: Confirm that these match the earlier Loan Estimate you received. Itemized Fees and Closing Costs : Validate all entries to ensure accuracy and reasonableness. Cash Needed at Closing: Verify the required amount and ensure it aligns with your financial arrangements. Discrepancies or unexpected figures should immediately be brought to your lender or title company’s attention. By addressing these questions early, you can avoid potential stress on closing day. Conduct a Final Walk-Through A final walk-through is your last opportunity to inspect the property before taking ownership. This step is typically scheduled 24 hours before closing and allows you to confirm that: Repairs : Any modifications or repairs agreed upon have been completed satisfactorily. Condition of the Property: Check that the property is in the expected condition, with no significant changes since your last visit. Presence of Fixtures and Appliances: Ensure that everything included in the sale is present and functioning. If concerns arise during the walk-through, raise them with your real estate agent right away to find a resolution before the closing meeting. This proactive approach can mitigate any last-minute surprises on the big day. Ensure Funds Are Ready On closing day, you will need to have all necessary funds ready to facilitate the transfer. Here’s what to consider: Exact Amount Required: The Closing Disclosure outlines the exact cash required at closing, which may include your down payment and closing costs. Payment Method: Most transactions require a wire transfer or certified cashier's check. Personal checks are typically not accepted, so you must ensure you have the proper format. Bank Arrangements: Give yourself ample time to arrange for fund transfers. Plan for potential delays in processing, and confirm payment methods with your escrow company. It’s crucial to coordinate with your bank and escrow officer to ensure the financial transaction goes off without a hitch. Confirm Your Appointment Time and Location Logistical details like the time and place of your closing should be confirmed well in advance: Location: Typically held at your title company’s office or your real estate attorney’s location. Confirm this with your agent ahead of time. Punctuality: Arriving on time allows the process to begin smoothly and prevents unnecessary delays. If your closing involves electronic signatures or remote participation, ensure you understand the technology requirements and have a reliable internet connection. This preparation helps facilitate a seamless virtual closing experience. Prepare for Signing Documents Closing entails signing a multitude of documents, each vital for formalizing your purchase. Key documents you’ll encounter include: Deed of Trust or Mortgage Document: This legally binds your property to the loan agreement, protecting the lender's interest. Promissory Note : Details your commitment to pay back the loan you’re receiving from the lender. Affidavits and Declarations: Various legal affirmations that may require your signature. They typically confirm the accuracy of the information provided during the loan application process. As you prepare to sign these documents, take your time to read each one carefully. It’s important to understand what you are agreeing to before signing. If you encounter any terms or clauses that are unclear, don't hesitate to ask questions for clarification. This is your opportunity to ensure that you are fully informed about your mortgage and the associated obligations. Anticipate Closing Costs Closing costs can significantly impact your finances, accounting for 2% to 5% of the purchase price. It’s crucial to understand what these costs entail, as they can include: Loan Origination Fees: Charges by the lender for processing the loan. Appraisal Fees: Required to assess the property’s value. Title Insurance: Protects against potential claims against the property title. Attorney Fees: If required in your state, these cover legal services for reviewing documents. Inspection Fees: These may include pest inspections and other assessments depending on the type of loan. Please make sure you know about all closing costs detailed in your Closing Disclosure. Understanding these costs allows you to plan your budget effectively and avoid any financial surprises on closing day. If needed, discuss with your lender whether any of these costs can be rolled into your loan amount to ease the upfront financial burden. Prepare for Any Last-Minute Changes The closing day can sometimes bring unexpected changes or needs for adjustments. Be prepared for any last-minute requests or changes in documentation as the closing process unfolds. Whether it’s a last-minute adjustment in figures or a request for additional paperwork, remaining flexible and responsive can help navigate these challenges. Keep communication lines open with your real estate agent, lender, and title company. Quick responses and collaboration can help manage any unforeseen complications that may arise. Celebrate Your New Home Once you’ve signed all documents and the transaction is complete, take a moment to celebrate your achievement. Closing day marks not only the culmination of a significant commitment but also the beginning of your journey as a homeowner. Collect your keys, take a few moments to relish this milestone, and envision the memories you will create in your new space. Conclusion: Embrace the Excitement of Closing Day Closing day is a remarkable occasion that signifies the fulfillment of your goal of homeownership. By following these tips, you’ll be equipped to handle the process smoothly and confidently. From organizing documents to preparing for financial obligations, thorough preparation can minimize stress and enhance the closing experience. Remember that True Concept Title Company is here to support you every step of the way, ensuring a seamless transition from contract to closing. By staying informed and organized, you can turn what may initially seem like a daunting task into an enjoyable and celebratory experience. Contact True Concept Title Company today for expert guidance tailored to your needs.

Purchasing a home is often the most significant financial investment a person makes in their lifetime. However, this process carries inherent risks, especially those related to the title of your new property. Title issues can arise even after the most thorough research and due diligence. Owner’s title insurance is an invaluable asset in guarding against unexpected claims and ensuring that your ownership rights are fully protected. Imagine completing the purchase of your dream home, only to discover undisclosed liens or claims from unknown heirs, threatening your ownership. Title insurance is designed specifically to prevent such worst-case scenarios. It steps in to defend your ownership rights, covering legal expenses and potential financial losses. Whether correcting errors in public records or resolving boundary disputes, title insurance is your ally in securing a clean title transfer. Here's an in-depth look at how this insurance mitigates risks and offers peace of mind during and after your home purchase. Comprehensive Protection Against Title Defects Errors in public records, undiscovered liens, or other encumbrances can arise even after a thorough title search. These mistakes can be as simple as a misfiled document, owner’s title insurance covers any such issues that could otherwise result in financial loss or impact ownership rights Example : Imagine purchasing a home and later discovering that the previous owner left unpaid property taxes, resulting in a lien on your title. Title insurance would cover the claim, freeing you from the burden of unexpected financial responsibility. Legal Defense Against Ownership Claims One of the most daunting challenges a homeowner could face is a legal claim questioning their ownership. Whether it’s due to a forgery in past transactions or heirs who suddenly emerge with claims to the property, title insurance provides vital legal backing. Example: Suppose an heir emerges years after you purchase the home, armed with a will that asserts ownership rights to your property. With title insurance, the insurer provides legal defense, covering costs associated with protecting your ownership. Assurance During Boundary Disputes Boundary and survey disputes are quite common and can significantly impact your enjoyment of the property. Issues may arise if previous surveys were incorrect or if property lines are contested by neighbors. Such disputes might affect your ability to use, alter, or sell your property. Title insurance assists in covering costs and resolving these disputes effectively. Example: If a neighbor contests the boundary defined by your fence, title insurance can cover the expense of a new survey or legal negotiations to ensure fair resolution. Financial Security and Policy Coverage Title insurance guarantees reimbursement for any covered financial losses, minimizing out-of-pocket costs, and provides coverage for as long as you own the property. Example : In the event of a successful claim against your ownership, the policy ensures you are reimbursed for financial losses up to the coverage amount. Peace of Mind in Property Ownership The assurance that comes with knowing your property rights are protected allows you to focus on enjoying your home without lingering legal worries. Example : Confidently transfer or sell your property in the future, knowing any potential title issues are covered and resolved, making your property more attractive and easier to sell. Conclusion: The Assurance of Owner’s Title Insurance Securing owner’s title insurance is a prudent step for any homebuyer, offering security and peace of mind against potential title defects. By partnering with a reputable title company, you ensure a stress-free purchase process, safeguarded against unplanned challenges. From past errors to future enjoyment, owner’s title insurance is the cornerstone of a secure homeownership experience—celebrate your new home, knowing your investment is protected. Call True Concept Title today for all of your title needs! 866-651-6224

A Home Equity Line of Credit (HELOC) can be an attractive option for homeowners looking to access their home’s equity. But like with any financial product, having a good understanding of what you’re getting into is essential to make the right decision. In this article, we’ll break down the expectations vs. reality of HELOCs – what you can expect when you apply for one and how it may differ from what you had envisioned. What to Expect: Qualifying for a HELOC To qualify for a HELOC, specific criteria must be met. You’ll typically need at least 20% equity in your home, a good credit score, and proof of income. The lender may also require other documentation, such as tax returns and bank statements. Once approved for the loan, the lender will place a lien on your home for the amount of money borrowed. If you default on the loan, the lender can take your home to recover their money. What to Expect: Interest Rates and Fees HELOCs usually have adjustable rates that are based on the prime rate. This can be beneficial because you won’t be locked into a fixed rate, but your payments could change depending on market conditions. Be sure to understand the terms of your loan’s terms and any potential interest rate hikes or changes. It’s also important to remember that additional fees may be associated with a HELOC, such as origination fees and closing costs. Be sure to ask about these upfront so that you’re not surprised by any unexpected charges later on. What to Expect: Repayment Terms Typically, HELOCs have a repayment period of 10-15 years, with the first few years focused on paying off interest only. After this initial period, you will begin making payments toward both the principal and interest. It’s important to remember that if you cannot make payments on a HELOC, the lender can take action against your home. As such, it’s essential to plan how you will repay the loan and be sure you’re comfortable with the terms before signing any agreements. Conclusion A Home Equity Line of Credit (HELOC) can be a great way to access your home’s equity, but it’s important to know what to expect before you apply. Be sure to do your research and understand the terms of the loan and any potential fees or repayment terms. With a good understanding of what you’re getting into, you can make an informed decision that is right for you. Thank you for taking the time to read this article. We hope that it has been helpful in understanding the expectations vs. reality of HELOCs. If you have any questions or need further assistance, please don’t hesitate to contact us. Best of luck! The True Concept Team.

When it comes to finding the right Clearwater real estate home, it pays to be choosy. Your home demands a level of trust that isn’t easily found in just any random source. You want someone who will provide you with detailed information on specific developments and features while also considering your unique needs. That’s why turning to a trusted source for Clearwater real estate homes is so important; you can ensure that your chosen property is perfect for your lifestyle and future value prospects and that you’ll have access to dependable services during each step of the process! The Benefits of Working with a Trusted Real Estate Agent When searching for a new home, having the help of an experienced and trustworthy real estate agent can be a huge advantage. A good agent will have in-depth knowledge of the local market and what it takes to make a successful real estate deal. They will be able to guide you through the entire process, from showings to the closing table, ensuring your time and money are wisely spent. Beyond that, they can provide invaluable insights into neighborhoods, schools, and any area amenities to ensure you know exactly what you’re getting when you sign on the dotted line. Working with a trusted real estate agent is critical to finding the perfect home. How to Find Reputable Agents in Clearwater When finding a reputable agent in Clearwater, you should start researching online. Check out customer reviews and see what past clients have said about the company. You can look into local organizations such as the Better Business Bureau or the local Chamber of Commerce to get an idea of any complaints that may have been made against the agents in the area. Ask friends and family who have previously worked with agents for their recommendations. Meeting with your potential agents in person is also highly recommended to get a feel for whether they’re genuinely trustworthy. Doing thorough research upfront will save you time and money, so you must take your time when searching for reputable agents in Clearwater. Tips for Choosing the Right Property for Your Needs Choosing the right property for your needs can be a daunting process. Before committing to a new property, take the time to research each option thoroughly so that you can choose an accommodation that meets your requirements without any hassle down the line. You want to ensure you have all the necessary information about the neighborhood and any potential problems with traffic, crime rates, and access to services and amenities. Additionally, it would be best to consider things such as the size of the home or apartment building you’ll be living in, whether or not there are parks or playgrounds nearby that you and your family can enjoy, and other factors that will impact your quality of life. Understanding Financing and Mortgages for Home Buyers It can be daunting for first-time home buyers to understand all the financing and mortgage options available. Educating yourself on these details can save you money in the long run and ensure you can find a loan payment option that is right for your budget. Knowing what kind of interest rates, terms, and restrictions to expect from different mortgages helps make sure you don’t end up paying more than necessary or committing to a long-term agreement that doesn’t meet your needs down the line. With so many online resources and experienced real estate professionals, getting informed about financing and mortgages should be easy for anyone contemplating buying a home. The Benefits of Working with an Experienced Real Estate Lawyer Working with an experienced real estate lawyer is essential to a successful transaction. An experienced lawyer can advise on complex laws and regulations, negotiate contracts, review title searches, and provide guidance through complex real estate deals. With their deep knowledge of the law and ability to think strategically throughout the process, an experienced real estate lawyer can help protect buyers from unexpected costs, identify potential risks from the start, and ensure a smooth closing. Working with a professional partner in each complex legal transaction is critical to providing the best possible outcome in real estate transactions. What Documents to Look For When Buying a Home Purchasing a home is a significant investment, and while the process may be exciting, it’s essential to ensure that the paperwork is handled correctly. When buying a home, ensure you’re provided with all the critical documents such as title deed or purchase agreement, warranty deed, mortgage papers, land survey or property map, and insurance policies. Reviewing these documents carefully can help protect you from future disappointments and financial risks associated with ownership – so don’t forget to thoroughly examine them before signing any contracts. Additionally, ensure that all outstanding taxes are paid before you sign any contracts, and always provide you get copies of contracts for your records. In conclusion, purchasing a home is significant and should be made carefully. Working with an experienced real estate agent can be a great asset throughout the process. They can help identify the right property for your needs, assist in understanding mortgages and financing, and inform you about essential documents for buying a home. Additionally, having an experienced real estate lawyer available to review records is invaluable as they know any legal matters that may arise. With research and due diligence every step of the way, you can ensure you purchase the perfect home for your family. Use these tips to ensure you find a trusted real estate agent in Clearwater who will help guide you throughout your home-buying journey.

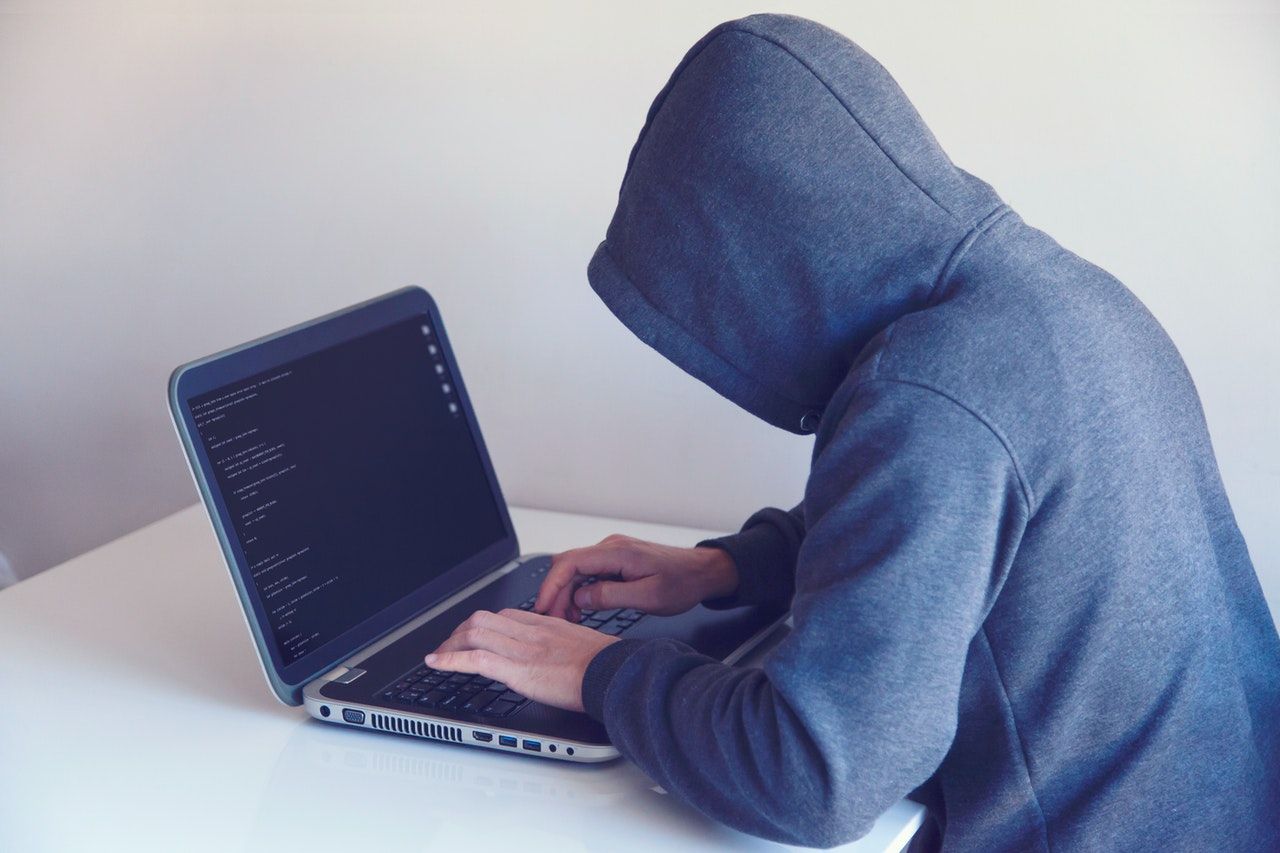

Real estate wire fraud is a serious issue that can result in significant financial loss. Here are some steps you can take to protect yourself: Confirm All Information Directly: If you receive wiring instructions via email, even if it appears to be from a trusted source like your real estate agent or title company, call them to confirm the details. Do not use the phone number provided in the email – instead, use a number you’ve used before or one you can find on their official website. Use Secure and Encrypted Communication: When sending any sensitive financial information, use encrypted email or a secure portal. Never send sensitive information through unsecured methods, like a regular email or text message. Be Wary of Last-minute Changes: Fraudsters may try to rush or pressure you into sending a wire transfer by claiming there are last-minute changes to the wiring instructions. Be suspicious of any such changes, and always verify. Educate Yourself About Phishing Techniques: Many fraudsters use phishing techniques to gather sensitive information. They may use email addresses, graphics, and language that appear to be from legitimate sources. Always double-check email addresses, and be aware that fraudsters often try to create a sense of urgency to pressure you into providing information or making a wire transfer. Use Two-Factor Authentication: If available, use two-factor authentication on your email and financial accounts. This adds an extra layer of security by requiring a second piece of information (like a temporary code sent to your phone) in addition to your password.

Real estate ownership, while rewarding, can sometimes lead to complex legal challenges, particularly when it comes to title and boundary disputes. At True Concept Title, we understand the intricacies of these disputes and are committed to helping you resolve them amicably. Let’s explore what these disputes entail and how you can address them effectively. Understanding Title Disputes Title disputes revolve around the legal ownership or rights to a property. They can stem from various sources: Unclear Ownership Records: Historical records that are incomplete or ambiguous can cast doubt on who rightfully owns a property. Document Errors: Mistakes in deeds, surveys, or legal documents can cloud the title. Fraudulent Transactions: Illegal property transfers can lead to competing ownership claims. Missing Heirs: Disputes can arise when a property owner dies without a clear will or designated heirs. Navigating Boundary Disputes Boundary disputes, in contrast, relate to the physical limits of a property. Common causes include: Unclear Property Lines: Over time, property boundaries can become vague, especially if they were not officially surveyed. Inaccurate Surveys: Faulty surveys can create disputes by failing to define property lines correctly. Misplaced Structures: Fences or buildings that encroach on a neighbor’s land can lead to disagreements. Adverse Possession: Someone might claim a portion of your property through adverse possession, sparking a boundary dispute. Steps to Resolve and Prevent Disputes Consult a Professional: Facing a title or boundary dispute? It’s wise to seek advice from a real estate attorney. They can evaluate the situation and offer legal guidance. Review Property Records: Dive into your property’s history. Examine deeds, surveys, and other documents to understand the land’s background and boundaries. Communicate with Neighbors: Often, a candid conversation with your neighbors can peacefully resolve boundary issues. They might be unaware of the problem. Hire a Surveyor: To accurately define your property lines, consider enlisting a licensed surveyor. They can provide definitive documentation to support your stance. Consider Mediation: Before heading to court, mediation can be a less confrontational and more cost-effective solution, potentially avoiding a lengthy legal process. Legal Action as a Last Resort: If other methods fail, legal action might be necessary. Your attorney can guide you through this process to protect your rights. Title and boundary disputes require a delicate balance of professional insight and personal diplomacy. By understanding the causes and taking proactive steps, you can navigate these challenges effectively. Remember, maintaining clear and accurate property records and boundaries is key to avoiding future disputes. Should you face such issues, True Concept Title is here to offer guidance and support, ensuring your property rights are well-protected. Need Help Resolving Title Disputes? If you’re dealing with a title or boundary dispute, don’t navigate these waters alone. Reach out to True Concept Title today for expert advice and support in resolving your real estate disputes amicably and effectively.

In the realm of real estate, the significance of title insurance is widely recognized as a means to protect buyers from various pitfalls. However, a less understood aspect is how mineral rights intertwine with title insurance, particularly in the context of the burgeoning oil and gas industry. At True Concept Title, we aim to clarify this intricate subject, helping you understand the implications of mineral rights on your property purchase. The Overlooked Aspect of Mineral Rights When buying property, especially in states like Ohio, Illinois, Michigan, Pennsylvania, and West Virginia, it’s crucial to realize that standard title insurance policies do not automatically include mineral rights. This means that if someone else holds these rights, you won’t acquire them with your property purchase, and, importantly, your title insurance won’t cover them. This exclusion typically falls under Schedule BII of the policy.

Navigating the complexities of a real estate transaction can be daunting. This is where a title company, like True Concept Title, becomes invaluable. Acting as a linchpin in property transactions, a title company plays multiple critical roles – from conducting title searches to ensuring a smooth closing process. Title Search and Review: The First Line of Defense At the heart of a title company’s work is the title search and review. This process involves meticulous examination of public records relating to the property in question. The goal is to inform all parties involved – buyers, sellers, and lenders – about the status and condition of the property’s title. This investigation is crucial in identifying any issues that could jeopardize the transaction, such as liens or foreclosure proceedings. The outcome of this search is typically presented in a preliminary title report or a commitment for title insurance, laying the groundwork for the next steps. Closing Agent: Orchestrating the Transaction Title companies often serve as the closing agent in real estate deals. This multifaceted role means they represent each party involved in the transaction. As a closing agent, the title company is responsible for gathering signatures on all closing documents and handling the financial aspects of the deal. They ensure that funds are correctly distributed and that vital documents, like deeds and mortgages, are accurately recorded at the local land records office. The Role of Escrow Officer In many transactions, the title company also acts as an escrow officer. They hold crucial documents and funds in escrow, following the specific instructions of the buyer and seller. For instance, the buyer entrusts the purchase money to the title company, while the seller provides a signed deed. The title company, in its role as an escrow officer, only releases these assets according to the agreed-upon terms, ensuring a fair and secure transaction. Issuing Title Insurance: A Shield Against Future Risks One of the most critical roles of a title company is issuing title insurance. This policy protects against future discoveries that could challenge the buyer’s property ownership. While the title company issues the policy, it acts as an agent for the insurance company, earning a commission. The insurance company itself bears the risk and receives the actual premium. This insurance is vital in safeguarding both the buyer and the lender against potential title-related losses. The role of a title company in real estate transactions is multifaceted and indispensable. At True Concept, we pride ourselves on delivering these services with precision and care. Whether you’re a buyer, seller, or lender, our expertise in managing title searches, facilitating closings, acting as an escrow officer, and issuing title insurance ensures that your real estate transactions are secure and seamless. Embarking on a real estate journey? Let True Concept be your guide and protector. Contact us today to ensure your transaction is in the best hands.

Navigating the Shadows: The Impact of Public Record Errors on Your Home’s Title Purchasing a new home is an exciting journey, fraught with complexities and historical baggage that could impact your title. It’s crucial to understand that even though your property is new to you, it might come with a past that includes errors in public records—a common issue identified during the title search process. Errors in public records, stemming from clerical or filing mistakes, can significantly affect the legal status of your property. These inaccuracies might relate to the property’s description, such as incorrect square footage, which can influence the loan amount a buyer is eligible for, potentially derailing the purchase process.

In 2023, a surge in Americans aiming to buy, sell, or refinance homes has spotlighted the critical role of understanding house titles for first-time homebuyers. Embarking on the journey to homeownership brings its share of excitement and learning curves, particularly when it comes to the intricacies of house titles. What Are House Titles? House titles are the cornerstone of property ownership, representing the owner’s rights to the property. Unlike the physical deed, which is the document transferring title from seller to buyer, the title itself is a conceptual representation of ownership. Ensuring you have complete ownership free from liens or claims by others is crucial, as these can impede your ability to sell the property in the future. Common Complications with Titles The path to clear ownership can be complicated by liens against the property or claims from third parties, such as a distant heir of a previous owner. Title companies play a pivotal role in identifying such issues through title searches before the sale concludes, ensuring the buyer doesn’t inherit unresolved debts.

Selling your home by yourself, commonly known as a For Sale by Owner (FSBO) transaction, can seem daunting at first. However, with the right preparation and understanding of the process from a title company’s perspective, you can confidently navigate through the complexities and successfully close the deal. Here’s a comprehensive guide to help you through each stage of the FSBO process. The Importance of the Title Company in FSBO Transactions The image of you and your buyer, surrounded by attorneys, sitting at a large table filled with forms inside a title company’s office, is not just the culmination of the home-selling process but a critical juncture ensuring the legality and security of the transaction. A title company plays a pivotal role in FSBO transactions, offering services ranging from title searches to handling escrow accounts, ensuring that the property is free of liens, and facilitating a smooth transfer of ownership. Accepting an Offer to Closing: Your To-Do List Once you’ve accepted an offer on your home, the real work begins. This phase involves several key steps: Hire an Attorney (If Necessary): Depending on your state’s laws, you might need an attorney to prepare certain legal documents or oversee the closing. Even if it’s not a legal requirement, having an attorney can help ensure your paperwork is in order, protecting your rights throughout the transaction. Order Title and Arrange for Escrow: Negotiate who will hire the title company and pay associated fees. Typically, the seller pays for the owner’s title insurance policy. Using your title company as an escrow agent can streamline the process, holding funds and important documents until the transaction is complete. Prepare for the Appraisal and Inspection: Ensure your home is in its best condition to facilitate a smooth appraisal and inspection. Address any minor issues beforehand to avoid complications. Negotiate Repairs: Based on the inspection results, you may need to negotiate with the buyer over repairs. Focus on addressing major defects rather than cosmetic issues. Get Your Paperwork in Order: Essential documents include the title to prove ownership, property taxes, loan documents, property survey, plans and permits, and homeowner’s insurance information. Closing with Confidence Closing involves reviewing the HUD-1 settlement statement, which details all financial transactions. Ensure you have all necessary documents, a photo ID, and your checkbook ready. Payments you might need to cover include your mortgage balance, any applicable commissions, and closing costs. Closing Costs in FSBO Transactions Closing costs are an integral part of the selling process, typically amounting to two to four percent of the purchase price. These can include escrow or closing fees, origination fees, home protection plans, attorney fees, transfer taxes, recording fees, notary fees, and title policy costs. Tying Up Loose Ends After closing, ensure all utilities are transferred or canceled, submit a change of address form, and arrange for the final payoff with your mortgage company. Collect all keys, remotes, and important documents for the new owners. Conclusion: The FSBO Journey from a Title Company’s Viewpoint Selling your home as an FSBO can be a rewarding experience, offering significant savings and a deep understanding of the real estate transaction process. By following this guide and working closely with a trusted title company, you can navigate the complexities of FSBO transactions with confidence. Remember, each step, from accepting an offer to closing the deal, is an opportunity to ensure a smooth and successful sale. Celebrate your accomplishment; you’ve not only saved money but also gained invaluable experience for future real estate endeavors.

If you are on a mission to refinance your mortgage to a lower rate in order to take advantage of your home’s equity and you are a former or current military member, a cash-out refinance may be just for you. A cash-out refinance loan exists specifically for military members thanks to the U.S. Department of Veterans Affairs (VA). Do you qualify for a VA cash-out refinance? Keep reading True Concept Title’s guide to find out if this loan option is for you and how it could help you achieve your financial goals.

Although True Concept Title offers our services nationwide, this one goes out to our homeowners in our home state of Florida! One of the most common questions we get from buyers, sellers, and industry professionals alike is how title insurance cost is calculated in our sunny state. While you may feel tempted to try and save costs by not purchasing title insurance, we heavily encourage you not to slip into this mindset. Plus, if you’re taking out a home loan, your lender will likely require you to purchase a lender’s insurance. Today’s article will explain title insurance, why you need it, and how much it costs in Florida. What is Title Insurance? Now before we explain how much it costs, you might be wondering – what even is title insurance? To put it simply, title insurance protects the legal ownership of a property. ‘Title’ refers to the legal deed authorizing you as the rightful owner. In some cases, clouds on the title may come up out of nowhere, potentially invalidating your rights as the owner. That’s where title insurance comes in. Title insurance protects both you and the lender from any liabilities or issues that may arise in the future. We’ll use the following example to explain. Say you close on a house and later find out that the previous owner had a huge pile of property tax debt. Title insurance takes that tax burden off of your shoulders. Without title insurance, you would have to settle the tax liability on your own or risk being kicked to the curb. What Does Title Insurance Cover? When you purchase an owner’s title insurance policy, you are personally protected as the owner from the following: Legal Claims These might impact your right to the property. Title insurance guarantees the company will defend your ownership and pay any resulting legal fees. Liens There are many types of liens, but they all refer to a debt that has yet to be paid. A title insurance agency will complete a thorough investigation of possible liens during a title search, but you will remain protected after closing. Title Defects Your title policy will keep you and your property safe if defects in ownership documents or unpaid taxes arise. You also may be protected from title theft. Forgery and Undisclosed Heirs In some cases, certain issues remain undisclosed at the time of purchase. This may include undisclosed easements or heirs as well as forgery. How is Title Insurance Cost Determined in Florida? The cost of title insurance in Florida ranges from $500-$1500, but several factors come into play. These may include: The property’s location Whether the property has the former owner’s insurance Whether you are refinancing or purchasing a new property Whether you are purchasing owner’s and seller’s title insurance How is Title Insurance Calculated? The state of Florida has defined five premium categories for paying title insurance. Policy Amount / Rate per $1000 $0.00 up to $100,000 / $5.75 $100,000 up to $1,000,000 / $5.00 $1,000,000 up to $5,000,000 / $2.50 $5,000,000 up to $10,000,000 / $2.25 Over $10,000,000 / $2.00 For example, assume you have an insurance liability worth $500,000, so we can calculate the title insurance cost. You can calculate the premium for the first $100,000 at $5.75 for every $1,000. This means you will multiply $5.75 by 100, so the first premium will cost $575. Since the remaining liability is $400,000, you will multiply at a rate of $5.00 per every $100,000. Therefore, you will multiply $5.00 by 400 to calculate the second premium value of $2000. Your total cost will be $575 + $2000, making your title insurance $2,575. Additional Costs On top of the owner’s coverage cost, you may have extra costs to acquire the property. This may include: Title Search Costs – you may have to pay an additional fee for this process Simultaneous Issue Costs – If you take a lender’s and owner’s policy out at the same time, you may have to pay extra fees Reissue Rate – If the previous owner had a title policy, you may have to pay a reissue rate Learn More > What Kinds of Title Insurance Do You Need? Title Insurance: Worth the Cost While you might feel reluctant to pay the price of title insurance, you’re much better off without the risk of paying the price if you don’t have it. Fortunately, title insurance is a one-time premium charge that will remain in effect until you are ready to sell. Since the payment is less than one percent of the appraised value, it is certainly worth the investment. If you’re purchasing a new home or refinancing, and you need title insurance, True Concept Title is ready to serve you. Our quick, organized, and reliable team of agents will help make the home buying process as smooth as possible so that you can get settled into your new home in no time. Contact our team today!

What is a Home Equity Line of Credit? A home equity line of credit (HELOC) loan allows homeowners to access the equity they’ve built up in their property. It is an essential tool for many homeowners who need access to funds quickly, and it has become increasingly popular in the mortgage industry over the last decade. This blog post will look at what a HELOC is and how it can benefit you. How Does a HELOC Work? At its core, a HELOC works like any other line of credit. Borrowers are given a certain amount of money they can use as needed, up to their credit limit. The lender keeps track of the balance, and borrowers must pay back the amount they borrow plus interest. With a HELOC, however, borrowers use their home equity as collateral. If borrowers fail to pay back their loans, lenders have the right to foreclose on their homes and take ownership of them. The Benefits of Using a HELOC: Given its potential risks, why would someone choose to use a HELOC? One reason is convenience—with most loans, lengthy application processes and underwriting requirements can delay approval or even deny your application altogether. A HELOC can be approved much quicker than other types of loans because lenders already have access to your home equity and don’t need additional information. Additionally, you can use only what you need up to your credit limit, so you won’t be paying interest on money that isn’t being used. Finally, HELOCs typically have lower interest rates than other loans, so you could save on interest payments overall. Conclusion: A home equity line of credit is essential for many homeowners who need access to funds quickly for unexpected expenses or home improvement projects. Though it does come with some risk due to its collateralized nature, it also offers several benefits, such as convenience and lowers interest rates compared to other types of loans. For these reasons, it has become increasingly popular in the mortgage industry over the last decade as an effective way for consumers to access funds when needed without having to go through lengthy application processes or wait extended periods for approval. At True Concept Title , we maintain a presence across the U.S. by providing a complete line of title and escrow services in every state. Our local approach to meeting your business’s needs complements our national strength, enabling you to expand your client relationships to reach a broader spectrum of opportunities.

When you creep up into your later years, you’re probably thinking more about the best ways to spend retirement. Maybe you’ve been saving up for a lifetime and are ready to cash out for that luxury home upgrade or new boat to take out on the lake. Although getting older may feel like a burden, there are many ways you can benefit as a senior. If you’re a homeowner over the age of 62, you are likely eligible for a reverse mortgage. This kind of loan allows homeowners to take advantage of their home’s equity to make the most out of retirement. Throughout this month, True Concept Title is exploring the reverse mortgage process and its benefits. In today’s post, we dive into what costs to expect when applying for a reverse mortgage. These include: Upfront MIP Origination Fee Title Insurance Appraisal Additional Fees Let’s get into the details!

If you’re not actively in the process of closing on a home, you likely don’t think much about title insurance. However, if you are involved in a home sale, you should make sure the parties involved have the necessary protection in the event that a cloud on the title appears. There are a variety of circumstances to how title issues could cause serious problems, both financial and emotional. True Concept Title is here with a guide to help realtors, homebuyers, and lenders understand title insurance and why it’s so important.

If you own a home and are over the age of 62, you may qualify for a reverse home mortgage. This can be an incredibly valuable route to take in order to fully enjoy your retirement. If you are a senior homeowner and want to take advantage of your home’s equity so you have an additional source of income, True Concept Title can help you through the process! Keep in mind, that there are certain documents you will need to get in order to finalize closing. Throughout this month, our real estate experts at True Concept Title will explain the reverse mortgage closing process and what documents you need to prepare. In this article, we dive into the following questions: What is a Reverse Mortgage? What Happens During a Reverse Mortgage Closing? What Documents Do You Need at a Reverse Mortgage Closing? What Documents Do You Receive at Your Reverse Mortgage Close? Keep scrolling for the answers!

Buying a new home is a very exciting process, but with that, it also tends to be very expensive. Fortunately, if you are looking to purchase a home on a budget, there are a variety of options that won’t completely drain your bank account. One potential option to explore is a real estate-owned, or REO property. Our national title and escrow experts explain what real estate-owned property is and explore the benefits of investing in REO property. Keep reading to learn more!

We hate to say it, but title fraud is a real threat that you need to be aware of if you are a homeowner or plan to purchase a home in the future. The FBI has discovered situations across the United States where home titles have been stolen. Identity theft reports have more than doubled since 2019, and more of these criminals are forging titles and stealing property. Do you know what home title theft is and how to ensure you avoid it? In the unfortunate circumstance that your title is stolen, do you know the appropriate actions to take? In this post, True Concept Title provides answers to these questions to help you stay protected from title fraud.

The home buying process is complex, so it’s important you hire the right team of specialists, especially if this is your first time purchasing a property. Throughout the journey, you will likely have to work with the following people: Mortgage lender Real estate agent Title insurance/escrow agent Real estate attorney Home inspector Appraiser As national title & escrow specialists , we know the ins and outs of the industry. Today, we share more on the legal side of a property transfer, what a real estate attorney does, and if you may need one. Do You Need a Real Estate Attorney to Buy a House? Buying a home is rarely a simple process but rather a complex transaction with legal strings attached and many steps of the process. Since the legal aspects of a home purchase can quickly become confusing for many to understand, home buyers or sellers may question if they should hire an attorney to protect them from any legal issues that can arise. This is a large investment and we believe you should do all you can to protect it. There are times that having a lawyer on your team can help you have more confidence in the purchase. Their guidance may help to ultimately reduce the costs of buying your new home.

Purchasing title insurance is an essential step in the homebuying process. Oftentimes, many mortgage lenders will even require that the buyer has a title insurance policy as a stipulation for receiving a loan. When you buy a title insurance policy, you will learn that it is just a one-time cost without additional monthly premiums. This may lead you to wonder, ‘ How long will my title insurance last if I’m not constantly paying for it? ’ A completely reasonable inquiry! The longevity of your title insurance policy will depend on what type of policy you purchase. Our team at True Concept Title reviews these different policies and provides an answer to how long they will last.

Whether you’re a first-time homebuyer or simply need a refresh on the process, closing day is an eagerly anticipated finish line that you want to pass with no bumps and/or bruises. There are a lot of steps to take when closing on a home, and you need to cover all your bases. To help you manage the process, our team at True Concept Title has compiled every action item in one checklist: Square away contingencies Clear the title ( with our team at True Concept! ) Acquire a final mortgage approval Review the closing disclosure Complete a final walk-through Bring the right documents If you follow all of these steps, you’re sure to have a better closing experience. Complete with the satisfying weight of your new keys in your pocket! Scroll for the details on each step to know what you can expect.

Once you’ve watched enough HGTV, you’ll likely realize the house flipping market is a great avenue to put your designer eye to use and simultaneously try to take home a profit. Although this process may not seem overly complicated, there are steps to take that can easily be overlooked-such as purchasing the correct insurance. New house flippers may try to work with their personal home insurance provider but fail to realize that flipping houses requires a specific type of insurance coverage. With a little bit of TLC, you can ‘upcycle’ fixer-uppers and see a significant return on investment, but make sure your property is protected with True Concept Title’s guide to the right flipping coverage .

If you own a house or are in the process of buying one, chances are you needed to take out a mortgage, a fancy word for borrowing money from a bank to purchase a property. Various factors can contribute to the amount you can borrow, the cost of your monthly payments, and the percentage of interest you must pay. But no matter the price tag, every homeowner looks forward to the day they own 100% of their home and owe no more money. You may want to better organize your finances if you have multiple debts. Regardless of your financial goals, you should have a clear picture of the amount you still owe on your loan and any other charges to your account. Although an early payoff of your mortgage may seem like an unattainable fantasy, in this scenario, a mortgage payoff statement is the best way to view an overall layout of what you owe.

Remember: you have a choice in title. If you have made an offer on your dream home and are ready to take it off the market, congratulations! You’re on your way to becoming a new homeowner. However, the battle for a smooth close has only just begun. One of the most crucial teammates you can have on your side is a reliable and knowledgeable title agent. Before hiring a title company to guide you through the home buying process, it is essential that you formulate the right questions to acquire all of the necessary information and feel confident in your decision. Our title experts explain exactly what to ask before choosing a title company. (And we’ll be honest, hope it helps you choose us.)

Buying a new home can be a confusing process. All the different steps and terminology of closing can be really overwhelming, especially if you are a first-time homebuyer. Fortunately, with the experts at True Concept Title, you can sigh a breath of relief. We can help take care of all the head-pounding details of home closing while helping you understand the steps of the process. Read our guide to grasp the 5 “E’s” of real estate terms.

When the big day arrives to close on your new home, you should have a title company, helping you complete the process in order to avoid possible legal or financial obstacles. A title company will manage the transfer of the title document, and the deed to the home. Before closing day, your title company will also conduct a thorough property title search to review the home’s ownership history and ensure the current owner has the legal right to sell. This step of buying a home is crucial to confirm there will be no legal concerns when transferring the title to the new homeowners. True Concept Title investigates the importance of a title search and how much this service generally costs. Read on to learn more.

When closing day finally rolls around, you are likely to feel a mixture of nervous anticipation and gratifying relief. However, don’t relax too much-not until the deal is officially finished. Your real estate agent may email you instructions to wire your closing funds to a specific account, but what happens if the payment leaves your bank account but never ends up where it’s supposed to? Unfortunately, cybercriminals are very vigilant to watch out for closing processes, with real estate agents being a hot target. Protect your money and avoid wire fraud with these tips from True Concept Title.

A lien is a claim or legal right against an asset, often established by a creditor or judge, that guarantees an underlying obligation. If the owner of the asset does not meet their obligation, such as repaying a loan, the creditor can seize the asset. Many people have liens placed on their homes if they have a mortgage , but there are several types of liens to be aware of. In this post, our title and escrow experts explain different types of liens, how they impact title, the damage they can cause, and how to remove them.

Prior to the financial crisis of 2007-2009, buying a foreclosed home was a challenging process that required the patience and time to either follow endless courthouse auctions or flip through stacks of legal paperwork. However, the wave of foreclosures brought on by the real estate bubble burst increased the number of easy-to-find available properties. Nowadays, the process of acquiring a foreclosed or real-estate-owned (REO) home isn’t all that different from your regular house hunt. The low prices of foreclosed homes make them an attractive investment to many homeowners, but there are steps to take and risks to consider to ensure you make the right decision. Keep reading for True Concept Title’s step-by-step guide to hunt, bargain, and close for a foreclosed home.

After a chaotic year in real estate full of home buyers scrambling to scoop up properties while prices shot through the roof, economists predict the 2022 market to be slightly more forgiving. Industry groups expect the supply of for-sale homes to increase while home prices rise at a slower rate. However, if you hope to buy a new home this coming year, now is the time to muster up some stamina and a solid strategy. Have you been searching for a new home but still feel nervous to jump into the deep end? The New Year is the perfect time to create a realistic and achievable game plan to buy a house. While the 2022 market may be slightly easier to navigate than last year’s market, thorough preparation is key for a smooth home buying & closing experience. Read on for True Concept Title’s tips to be a savvy homebuyer in the New Year.

Purchasing a previously foreclosed home from a bank or lender can be a great financial real estate move. This is a great way to secure a home that may otherwise not be in your price range, or it may be a great investment to rent out or flip to resell for a profit. Whatever your reason is for buying a real estate-owned (REO) home, you should make sure you protect your new investment with REO title insurance. Title insurance is always important when purchasing a home, but with an REO property, it is especially so.

In the head-spinning process of buying a home, one of the most critical documents to a smooth transition from seller to buyer is the title report . With a legal document called a title, a homeowner can provide proof of ownership and verify the legal status of the property. A title report is designed to disclose a property’s most important information and is intended to ensure a property is free of any legal defects that could potentially decrease the land’s value. When buying your new home, it is crucial you know who you’re buying from and that they legally have the right to sell it to you.

Are you in the process of building a new construction home? New homeowners that are building new construction homes often assume incorrectly that they do not need title insurance , as no one has ever lived in their home before. But that assumption is wrong, and the title experts at True Concept Title explain why title insurance on a new construction home is so important. Title Insurance 101 To understand why having title insurance is important, even for a new construction home, it is first important to understand the basics of what title insurance is. If you are purchasing your home through a mortgage lender, you will know that you are already required to have title insurance. Knowing that the mortgage lender requires title insurance, should make a new homeowner want to protect their new home financially as well. Title insurance also protects your ownership as well as protects you against any unforeseen or hidden title issues. When you purchase a property, even new construction, an exhaustive title search is performed. Sometimes these searches bring up title defects and issues that can be cleared before closing, but sometimes these issues can arise after closing. Let’s look at your new construction home. Your home’s lot may have been subdivided from the developer who bought a large parcel. It is not uncommon for the entire parcel to be subject to claims post-closing. Some common title defects may include: Forgeries Problems with power of attorney Sale without an heir’s permission Discovery of will that affects the property Problems with liens Undisclosed spouse with an interest in the property And finally, while you may assume that your developer and builder were of good standing, it could come out post-closing that there is a contractor’s lien (also known as a mechanic’s lien or construction lien) against the property and the lien must be paid by the new homeowner. Without title insurance, if a contractor’s lien is found post- closing , you will be responsible to pay for the costs to resolve the lien out of pocket. Understanding the Common Misconception of Title Insurance for New Construction Saving money here and there can add up over time. Who doesn’t want to save money? Often, new homeowners building new construction homes may assume they do not need to purchase title insurance and opt to save the money. After all, it may be worth saving the small expense when no one has ever lived in your new construction home before, so there is nothing to worry about… right ? Wrong. Many new construction buyers assume that the title to their new property Is free of any disputes. They assume that the developer or builder has taken all the correct steps to resolve any outstanding issues on the title . But that is where you can get into big trouble, a new construction home is just as prone to title issues as an older home, and the cost of disputing it is not cheap. What Title Insurance Will Do for You When you purchase title insurance you pay a one-time premium. Once purchased, if there ever are any disputes over ownership, liens, or outstanding payments, the title insurance will cover the legal fees to defend your title interest. In a worst-case scenario, you could lose the property and no longer have the resources to replace it, whereas title insurance would cover that. Title insurance also protects your heirs. If you own the property, your title insurance remains active and effective. You can safely pass the property to your heirs knowing the rights to the property and home are protected. Protect Your New Construction Home with Title Insurance No home—old or new—should be without title insurance! Do not be caught off guard by incorrectly assuming that just because your home is new that it can’t have previous issues or defects that are now questioning your ownership. Purchasing a home without title insurance is never a good idea. To learn more about protecting your new construction home with title insurance contact True Concept Title today at 813-263-7168!

When it comes to real estate purchases, buyers and seller’s agents tend to get the most attention. But, here at True Concept Title, we know that the title company is often the unsung hero of the transaction. The title company works behind the scenes to keep the property purchase on track. The title company has a lot of responsibilities that relate to the closing . Our job begins after the buyer and seller sign their sales contract, and it doesn’t end until after the property sale completes and you get the new keys. To help buyers, investors, and partners like mortgage agents understand the closing process better, we explain what you can expect your chosen title company to do. Title Search The title company’s first job is to research the property’s history of ownership, chain of title, and to identify encumbrances on the title. Some examples of this would be a mortgage, a tax lien , or an easement. If the title search finds any of these potential issues, the title company works to clear them. The title company puts all of its findings together in a report called an abstract of title. The fact is – the title company is a major part of any real estate sale. We are highly involved in the paperwork needed to make everything official. Accuracy is what’s most important to us above all. Title Insurance The title company issues title insurance . This guarantees the title is free from encumbrances. The buyer has to buy enough title insurance to protect the lender against any loss due to encumbrance on the title. Closing Documents Closing day can be summarized as two separate transactions: the home purchase and the mortgage loan. These transactions have many documents associated with them. These documents include the deed, the mortgage and promissory note, insurance policies, and disclosures. It is the responsibility of the title company to prepare each of these documents and obtain the required signatures. The title company issues title insurance guaranteeing the title is free from encumbrances. For a smooth sale, new home purchase, or mortgage refinancing, it is essential to choose a title company that you can trust. Escrow Payments Property tax and insurance are fees that buyers prepay at closing. The title company collects these fees and deposits them in a special escrow account for disbursement to the correct companies and taxing authorities. Cash Disbursements During a real estate closing, a lot of money changes hands. The buyer pays a down payment, insurance premiums, and property tax. The lender then pays the seller the amount due after the down payment. The seller then repays the balance on their mortgage in addition to any additional property tax they may owe and to their broker’s commission. Then, part of that commission goes to the buyer’s broker. The title company and anyone else involved in the sale also need to be paid. The title company figures out how the money is disbursed, records it on a HUD-1 statement, prepares checks, and then disburses the funds to the correct parties. Deed and Mortgage Recording Once the closing ends, the title company records the deed and mortgage. This is the step that makes the sale public record to serve as evidence of the property’s ownership. You Have a Choice, Choose True Concept Title The fact is – the title company is a major part of any real estate sale. They touch the money and the paperwork needed to make everything official. For a smooth sale, new home purchase, or mortgage refinancing , it is essential to choose a title company that you can trust. Consider us for your next real estate purchase. True Concept Title works hard to be the best in the business. Our national title specialist will work diligently to make your property purchase as painless as possible. Accuracy is what’s most important to us above all. Contact us to learn more today.